Williams is a life-long taxpayer advocate who has archived the state’s largest collection of government waste. Jason heads both the Taxpayer Association of Oregon Foundation and its sister organization, Taxpayer Association of Oregon.

Tax revenue from sales of cannabis in Oregon is forecast at $300 million or more for the 2019-2021 biennium, according to the Portland Business Journal, and now the Legislature will be grappling with how to divvy up the bounty. The state brought in $46.9 million in cannabis taxes during the first quarter of the 2021…

READ MORE

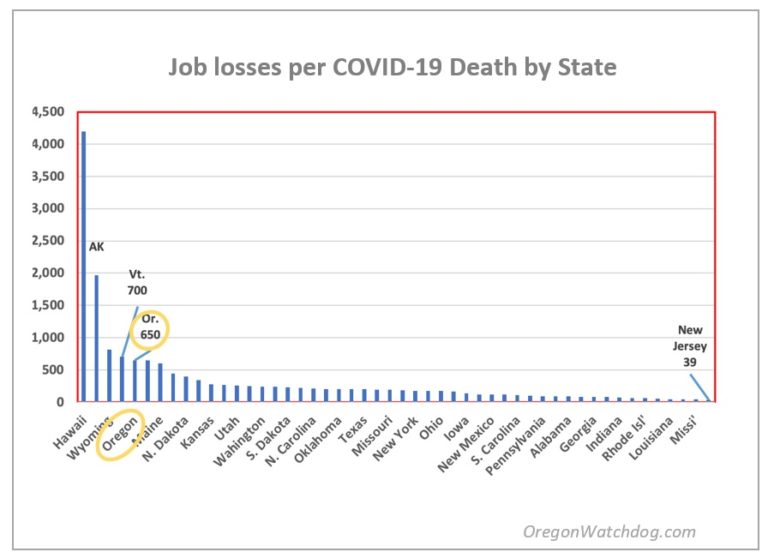

By Taxpayer Foundation of Oregon, The state of Oregon has paid $4.1 billion in unemployment claims since the COVID-19 pandemic began, but the acting director of the Oregon Employment Department faced criticism for delays in issuing payments to claimants, according to a KPTV report. Since the novel coronavirus shut down businesses, government agencies and nonprofits…

READ MORE

Here is the list Measure 108 – Tobacco, cigar, vaping tax Metro #26-218 business tax traffic, safety, transportation programs Multnomah #26-211 bonds, libraries Multnomah #26-213 five-year levy, restore recreation programs, parks, nature, water Multnomah #26-214 income tax, tuition-free preschool program Multnomah #26-215 bonds modernize & repair schools Multnomah #26-216 five-year local option tax, district operations…

READ MORE

By Taxpayer Association of Oregon Foundation, Fact: Virus cases could’ve been reduced by 95% if China had acted three weeks sooner according to Southhampton University. Timeline of China’s cover-up November 17, 2019. The first case of Coronavirus is discovered in China. A few weeks later (Dec. 6) the first case of human-to-human transmission…

READ MORE

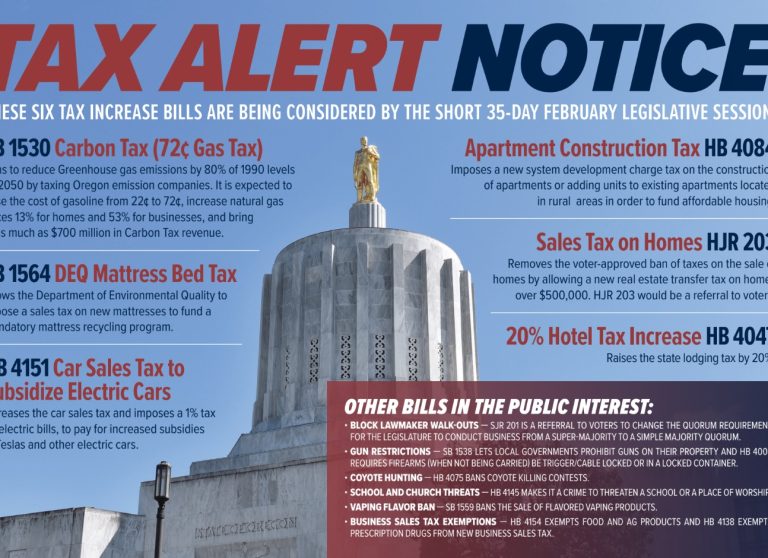

Tax Alert Notice: These six tax increase bills are being considered by the short 35-day February Legislative Session. Carbon Tax (72-cent gas tax): SB 1530 Aims to reduce Greenhouse gas emissions by 80% of 1990 levels by 2050 by taxing Oregon emission companies. It is expected to raise the cost of gasoline from 22 to…

READ MORE

By Taxpayer Foundation of Oregon, Like David and Goliath, residents of a tiny town on the Oregon Coast are battling Facebook, one of the world’s largest tech companies, over the social media company’s plans to build a landing spot for undersea cables. Residents in quiet Tierra Del Mar, about 65 miles southwest of Portland, worry…

READ MORE

Oregon taxpayers may see an even larger “kicker,” a credit on their 2019 personal state income tax returns, than previously anticipated. Previously, taxpayers were expected to receive an average $370 million refund in 2020 — now that kicker tax refund may grow much larger. The Oregon Department of Revenue noted that the kicker for 2018…

READ MORE

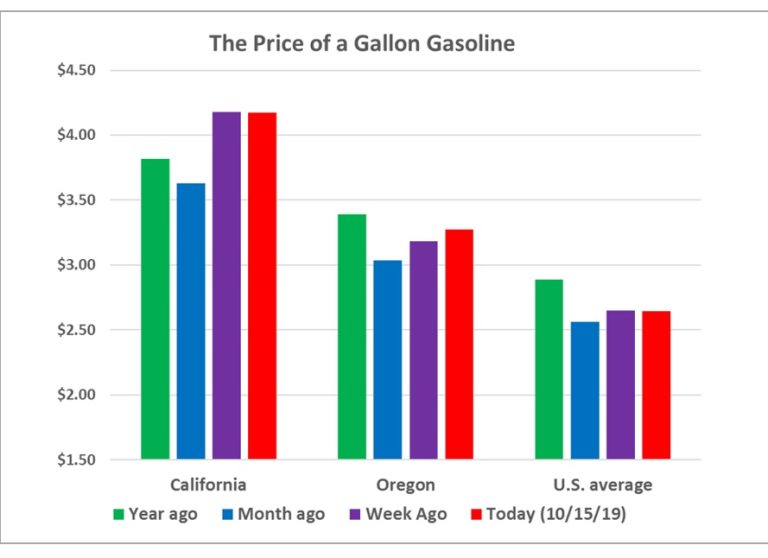

By Bob Clark, Taxpayer Association of Oregon Foundation Back in the year 2012, world oil prices are still at a peak and California is preparing to launch in 2013 its Cap and Trade Program to reduce CO2 emissions. Not to fall behind California, Oregon state politicians earlier this year (2019) attempt to enact approximately the…

READ MORE

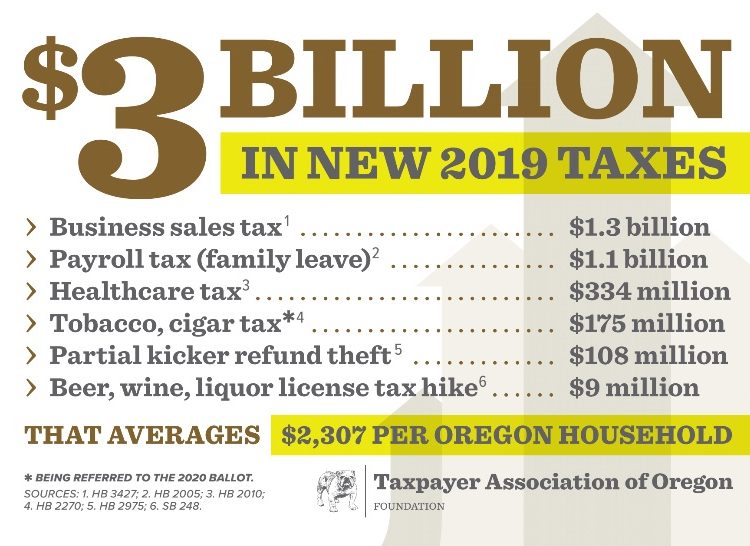

$1.3 billion Business Sales tax (HB3427) : House Bill 3427 (also called “Student Success Act”) imposes a 0.57% Commercial Activities (gross receipts) Tax on “business activity” (sales) exceeding $1 million per year, minus 35% of the “cost of inputs” (e.g. materials) or labor costs, plus a flat fee of $250. It taxes business sales revenue…

READ MORE