By Taxpayer Association of Oregon

Governor Kate Brown and some lawmakers say the State of Oregon is facing a $1.7 billion budget shortfall in the 2017-19 biennium. Yet, this shortfall is in the face of all-time high tax money coming in to state government.

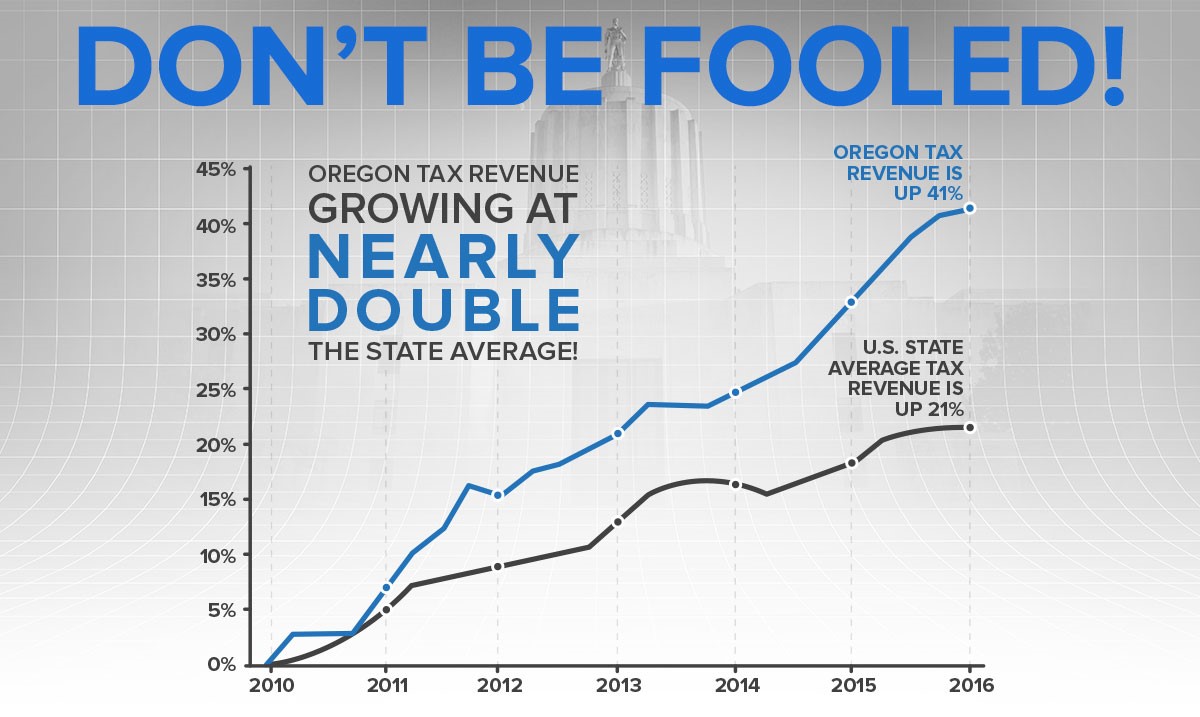

Research published by the Pew Charitable Trusts finds that Oregon has seen the some of the fastest growth in tax revenues since the end of the Great Recession.

Pew’s comparison of each state’s tax receipts show that since 2010, Oregon had the third largest recovery among the states. On average, states have seen tax revenues grow by 21 percent. At 41 percent growth, Oregon’s tax revenues grew at nearly double the state average.

Despite the drop in revenues during the recession, Oregon has the 7th largest growth from its pre-recession peak. On average, states have seen tax revenues grow by 6 percent since their pre-recession peaks. Oregon’s tax revenue growth was more than 16 percent since the end of 2008.

In her inaugural address, Governor Kate Brown blames more than $1 billion of the shortfall on the state’s choice to expand Medicaid and other taxpayer funded insurance. Public employee pension costs account for another $340 million, according to the governor.

Deficits are caused from spending outpacing revenues. Despite Oregon’s record rate of revenue collection, state spending plans have increased even faster. In this way, Oregon’s deficit is driven by too much spending, rather than not enough revenue.

While Oregon does not always exceed the state average and sometimes will be hit harder in past recessions, it is very unusual that they would take this long stretch of surging revenue and communicate that the state is cash poor and in need of billions in higher taxes.