Release by Josh Lerner,

Office of Economic Analysis,

Just a quick update on the quality of Oregon’s job growth in recent years. This continues our office’s work on job polarization — the fact that much of the job growth is concentrated in both the high- and low-end of the wage spectrum. As discussed before, the best way to examine job polarization is looking at occupational data. Recently we examined national trends and the following is an Oregon analog. So far in recovery Oregon has seen polarized job growth, just like the nation however our growth differs in the fact that a) it is stronger overall b) our middle- and low-wage growth is actually a bit slower than the nation and c) our high-wage growth is substantially stronger than the average state. The high-wage gains are largest in management occupations (likely influenced by headquarter operations) but also strong in computer and math, business and finance, and architecture and engineering. Oregon’s “good polarization” growth — the combination of high- and middle-wage jobs — is the 12th strongest across all states. See the map in the national post for more.

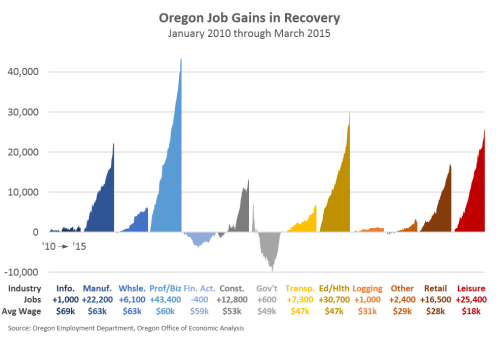

While occupational data is best for examining job polarization, it can be useful to look at individual industry trends as well to see the breadth and scope of the jobs being created. The following shows job growth in Oregon by major industry from January 2010 through March 2015. The industries are ordered from left to right based on their average wage according to the 2014 QCEW data. Here, one can see that across industries, Oregon has seen some broad-based gains but growth is stronger in industries with both above- and below-average pay.

While occupational data is best for examining job polarization, it can be useful to look at individual industry trends as well to see the breadth and scope of the jobs being created. The following shows job growth in Oregon by major industry from January 2010 through March 2015. The industries are ordered from left to right based on their average wage according to the 2014 QCEW data. Here, one can see that across industries, Oregon has seen some broad-based gains but growth is stronger in industries with both above- and below-average pay.

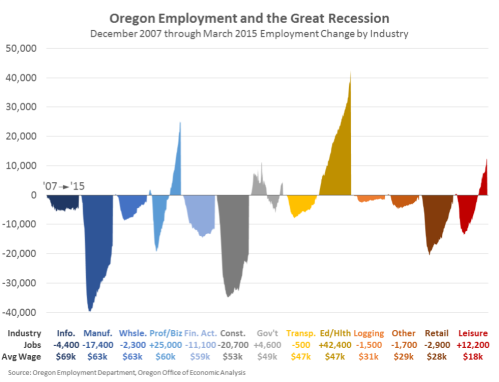

While focusing on gains in recovery is more important for understanding the economy and trends today, it is also helpful to take a step back and look at the bigger picture over the business cycle. Below is the same style of graph by industry, however we start from the onset of the Great Recession.

One of the interesting items in this last graph is the fact that your eyes can be deceiving. Today Oregon has about 20,000 more jobs than back in late 2007, however, visually it’s hard to tell that given only 4 of the 13 industries are currently at an all-time high. The bigger picture trends — winners and losers over the business cycle(s) — have long-lasting and far-reaching impacts on the economy and labor market. These are easiest to see in the manufacturing and goods producing industries (timber/forest sector) of course as the economy has and is transitioning more and more to services. Additionally, see here for our office’s outlook for middle-wage jobs more broadly.