By Taxpayers Association of Oregon Foundation,

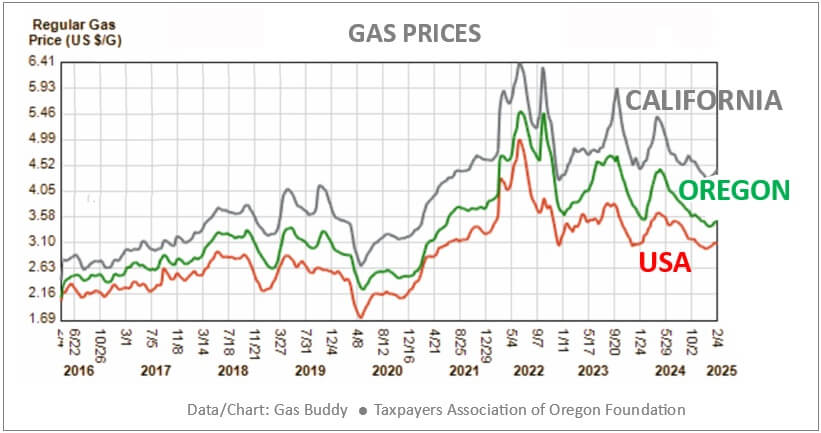

As the chart shows, Oregon has been paying nearly 50-cent more per gallon than the national average, and Oregon is neighbor to a major oil refinery state. Also, California is sky high above the national gas price average.

You are paying a lot more at the gas pump because of Oregon’s hidden gas tax, and yes, California has the same hidden gas tax scheme. Yet this secret hidden gas tax does not even go towards fixing our roads like the regular Oregon gas tax.

National gas prices have been steadily increasing, notably during winter months when they usually see a drop. California and Oregon gas prices stand out. But an even closer look seems to show a widening gap in anticipation of both states’ “Clean Fuels” programs. That gap has yet to correct itself.

In the 2015 Legislature, SB 324 (Permanent Clean Fuels) passed the Oregon Senate and House on a mostly party-line vote. Gov. Kate Brown quickly signed it.

The Clean Fuels Program mimicked California and forced higher ethanol content in gasoline or the purchasing of “environmental credits” by fuel companies. The Department of Environmental Quality regulates the credit market. By forcing fuel companies to purchase these credits it becomes a tax on gas, but unlike the real gas tax, which funds our roads, this gas tax revenue rewards certain private energy companies. Taxpayers pay the cost but do not reap the benefit.