Press Release Provided by Josh Lerner,

Office of Economic Analysis,

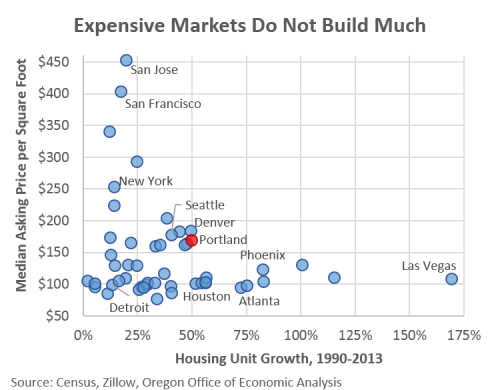

This edition of the Graph of the Week highlights the relationship between home prices and new home construction across the 50 largest metros in the country. (Original graph idea from Jed Kolko, formerly of Trulia.) It comes out of some work Tim Duy and I did recently in a different venue but is important to highlight. In essence, expensive housing markets do not build much new construction. Portland, along with other popular cities like Denver and Seattle, are right on the middle of the curve, essentially indicating that we’re adding just enough housing to keep affordability at a somewhat manageable level. These regions are keeping their heads above water, but just barely.

Find an interactive version of the graph here.

In talks I have been framing this as the choice we face. Either the region builds enough homes and apartments to keep affordability from getting worse, or watch as the region slides into the unaffordable category. I realize many already find Portland unaffordable. Using the benchmark of 30% of income spent on housing as the threshold, 37% of homeowners spend more on their mortgage and 52% of renters do likewise (2013 ACS data.) A relatively new line of research, new to me at least, is focusing on 45% of income spent on housing and transportation costs as affordable. To the extent that a household can afford to spend more on rent given they live close to work, or have good public transit or other mode options, this makes sense. Similarly, housing is generally more inexpensive on the outskirts of the metro, but transportation costs are generally higher as well given longer commutes. The worst problems arise when both categories are high for a given household.

Finally, such a high level look leaves to the side many different and important facets of the housing discussion, from land use policy and zoning to neighborhood character and gentrification. All of these are important topics should Oregonians want to have the conversations, but also lie largely outside the realm of economics or supply and demand. However supply and demand goes a long way toward explaining today’s level of housing affordability as discussed previously (HERE and HERE, e.g.)