By Bob Clark, Taxpayers Association of Oregon Foundation,

High-income taxes and a high cost of living hurt Oregonians.

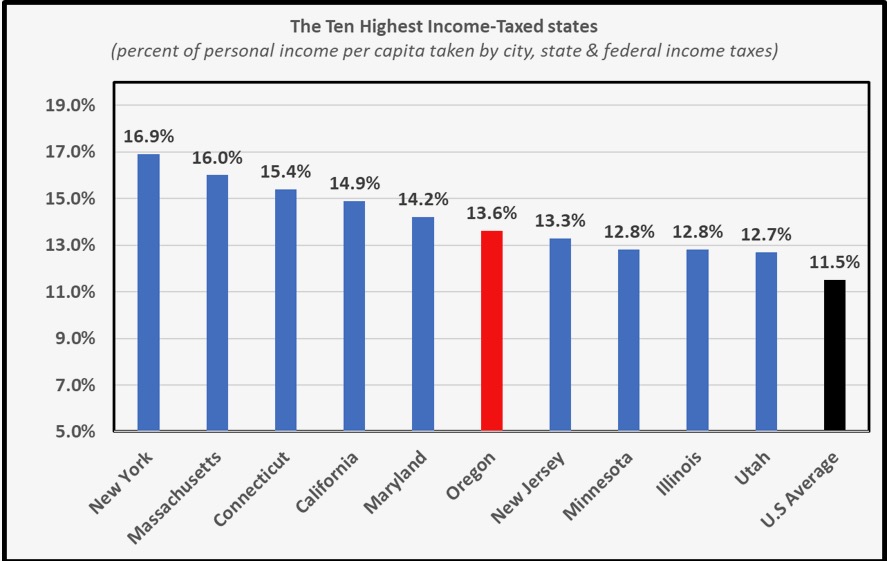

In its latest reporting, the U.S Bureau of Economic Analysis (BEA) ranks Oregon sixth highest in income taxation, among the 50 U.S states (when combining local, state and federal income taxes for each state).

(This chart is of total income tax burden averaged over the entire population of a state, measured by taking the difference between before-tax and after-tax income and dividing it by before-tax income. Average rates tend to be substantially less than marginal income tax rates. Up to half of all U.S. citizens do not pay any federal income taxes, as they tend to have relatively low income, not meeting thresholds.)

Relatedly, Oregon does have one of the nation’s higher marginal state income tax rates (ranking 5th highest among U.S states, according to the Tax Foundation, 2024 State Income Tax Rates and Brackets | Tax Foundation.

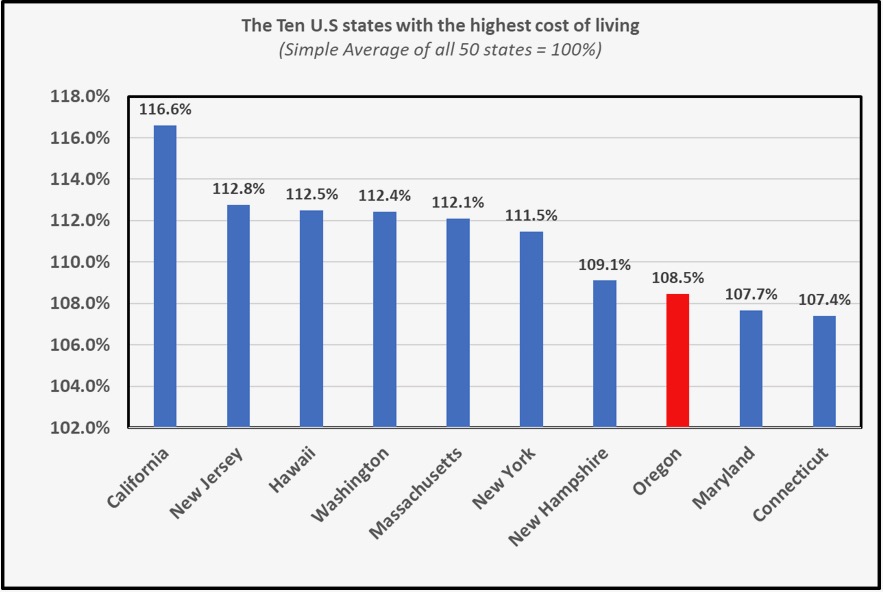

In its latest reporting, as written in my recent Catalyst article, the BEA also ranks Oregon as having the 8th highest cost of living among the 50 U.S states.

The Biggest contributing factor to Oregon’s low ranking for real after-tax income is its high cost of living. Using 50 state averages for income tax rates and cost of living rates, Oregonians lose roughly $1,400 per year on average from excess income taxation than other states; but Oregonians also lose $4,600 per year on average from a higher cost of living than in other states.

Oregon’s higher cost of living is not only caused by the cost of shelter which is 20% more expensive than the 50-state average but also caused by the cost of goods which are 7% more expensive than the 50-state average.

Energy, such as the cost of gasoline and diesel, is said to be a substantive part of the cost of the goods portion of the Consumer Price Index, as calculated by the U.S Bureau of Labor Statistics. As for energy, Oregon ranks 10th highest for state gasoline taxes among the 50 states by the Tax Foundation, and including Oregon’s clean fuel program cost (nearly 10 cents per gallon) likely pushes Oregon’s cost ranking even higher than tenth.

It sounds like the Oregon legislature is contemplating increasing the gasoline tax and quite possibly also adding a delivery tax, which would tend to exacerbate Oregon’s high cost of goods. (2024 State Gas Tax Rates | 2024 Gas Taxes by State)

As for the high cost of Shelter in Oregon, Dave Hunnicutt (Executive of the Oregon Property Owners Association) writes recently that Oregon needs to liberalize its land use laws to open new lands for housing development and bring down the cost of housing. (Hunnicutt strikes on an idea which could help finance the public infrastructure necessary for opening new lands, and that is, allowing the owners of such land (for instance, farms) to sell their lands at a discount from what a totally liberalized market would allow, which effectively would provide a wealth transfer to developers or local governments to help finance the infrastructure.) (A Tale of Three Cities: Oregon’s Housing Crisis Exposes Government Priorities – Oregon Property Owners Association)

Oregon’s current housing approach is problematic, as pointed out in Hunnicutt’s article. But I would also add that Oregon’s current housing approach of having the government itself fund more housing construction relies on increasing the tax burden on Oregonians which tends to substantially offset the benefits of reduced housing costs.

To conclude, The Oregon Business and Industry organization sums ups Oregon’s current business condition with the following statement:

“By and large, these updated national rankings do nothing to change our conclusion that Oregon has a great deal of work to do if it wishes to remain competitive.”

The Oregon Business and Industry report on Oregon’s business competitiveness echoes the BEA data I present here and can be found at the following link: Oregon’s Economic Competitiveness – Oregon Business & Industry.