Oregon’s Prosperity Roadmap: Mistaking Bureaucratic Activity for Economic Progress

By Dr. Eric Fruits

Economist International

Guest opinion by Taxpayers Foundation Oregon

Governor Tina Kotek’s “Oregon Prosperity Roadmap,” released in December 2025, arrives during an economic emergency for the state. Oregon faces sluggish job growth, elevated unemployment projected through 2026, and declining population as businesses and residents leave. These symptoms form a self-reinforcing fiscal cycle: rising tax burdens and escalating costs necessitate service cuts, which accelerate the exit of higher-income residents and capital.

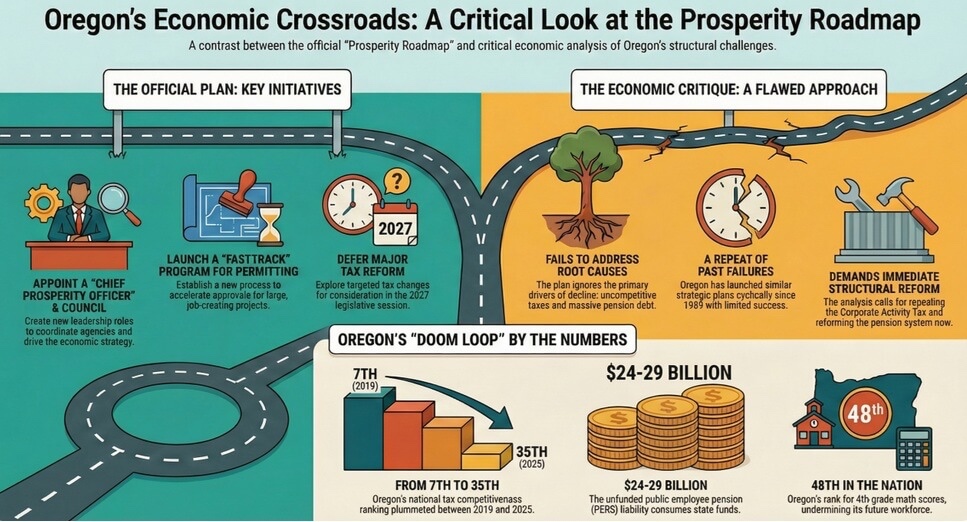

The Governor’s response outlines goals such as moving Oregon’s business rank from 39th to the top 10, accelerating GDP growth above the national average (from 1.7% to 2.2%), and creating a Chief Prosperity Officer (CPO).

The Roadmap, however, misdiagnoses the state’s crisis by treating structural pathologies—rooted in high costs and uncompetitive taxation—as problems of coordination and administration. Relying on process improvements and aspirational targets while deferring substantive fiscal reform represents a continuation of policies that have failed to arrest Oregon’s competitive decline for decades.

The Anatomy of Oregon’s Structural Decline

Oregon has systematically dismantled its competitive advantages over the past five years. The state’s Tax Foundation State Tax Competitiveness Index ranking plummeted from 7th to 35th nationally between 2019 and 2025.

The Corporate Activity Tax (CAT), a gross receipts tax implemented in 2019, assesses 0.57% on commercial activity above $1 million. Gross receipts taxes create pyramiding effects, burdening low-margin businesses and distorting production decisions. This tax layers atop one of the highest individual income tax structures in the nation; Portland residents face a marginal income tax rate that can exceed 13.9% for high earners, ranking second in the U.S.

The state’s human capital pipeline is degrading rapidly. Fourth-grade students rank 48th in math and tied for 46th in reading on the 2024 National Assessment of Educational Progress (NAEP). Per-pupil spending reaches $19,400, the 15th highest nationally, yet educational outcomes remain among the worst.

Migration data confirms the doom loop mechanism. The average Adjusted Gross Income (AGI) of residents moving into Multnomah County ($73,540) is substantially lower than those moving to adjacent Clark County, Washington ($106,715)—a gap of $33,175. This stratified migration pattern cost Multnomah County approximately $1 billion in taxable income between 2020 and 2021 alone.

Ignoring the PERS Crisis

The Roadmap fails to confront the fiscal burden imposed by the Public Employees Retirement System (PERS). Oregon’s unfunded pension liability stands between $24 billion and $29 billion, roughly equivalent to the state’s entire biennial General Fund budget for 2023-25. Required contributions now consume 27 cents of every payroll dollar for public employers—the highest rate in the system’s history.

This pension obligation represents a structural, long-term fiscal commitment that no amount of administrative coordination can overcome. Funds that should be available for competitive wages, capital investment, or improved public services are diverted to covering past pension promises, putting austerity on autopilot. By deferring substantive mention or reform of the PERS crisis, the Roadmap ignores the largest structural barrier to fiscal health and competitive taxation.

A Failed Policy Cycle

Oregon has been cycling through iterations of strategic economic planning for more than 35 years.

- Governor Neil Goldschmidt’s Oregon Shines (1989) established statewide goals and created the Oregon Progress Board to track benchmarks—a mechanism strikingly similar to the proposed Chief Prosperity Officer and Governor’s Prosperity Council.

- Governor Ted Kulongoski (2003–2011) championed “Industrial Site Readiness” and permit streamlining.

- Governor John Kitzhaber (1995–2003, 2011–2015) launched the “Community Solutions Team” and “Regional Solutions.”

- The Business Oregon 2018-2022 Strategic Plan, under Governor Kate Brown, contained five priorities that were virtually identical to the current Roadmap.

The repetition of these efforts indicates a failure of the core state bureaucracy to implement lasting change. The history of limited effectiveness suggests that these strategic plans function as political signaling devices—substituting process management for genuine structural reform.

Critique of the Roadmap’s New Administrative Architecture

The Roadmap’s “Next Steps” focus on creating new administrative layers, which cannot overcome existing statutory barriers.

Creating a Chief Prosperity Officer to “refine and expand” goals and “coordinate cross-agency efforts” duplicates existing functions. Oregon already has Business Oregon and the Regional Solutions infrastructure intended for coordination. Economic development effectiveness depends primarily on fundamental cost factors—tax burden and regulatory environment—not coordination mechanisms. No Chief Prosperity Officer can overcome an economy rendered uncompetitive by a 35th-ranked tax structure.

The proposal to establish a “FastTrack Program” modeled after the federal FAST-41 has merit because federal research suggests FAST-41 can reduce permitting timelines by approximately 18 months. However, the fundamental obstruction to large-scale development in Oregon is the legal framework of land use (SB 100) and the extensive standing granted to third parties to litigate decisions through the Land Use Board of Appeals (LUBA).

No amount of “fast tracking” will work if a project can be stalled by years of land use litigation. Unless the proposed 2026 legislation includes statutory preemption that limits the grounds for LUBA appeals, the FastTrack Program will function as little more than a dashboard for observing delays.

Businesses cite the cumulative tax burden, regulatory climate, and deteriorating quality-of-life concerns (such as public safety and urban decay) as more significant factors than permitting speed. Implementing administrative reform without confronting substantive tax and regulatory laws is analogous to performing physical therapy on a patient experiencing cardiac arrest.

The Roadmap directs exploration of “Targeted Tax Changes” for consideration in the 2027 legislative session. Delaying concrete tax action until 2027—more than two years after the Roadmap’s release—signals to mobile capital that no immediate relief is forthcoming. This deferral eliminates the possibility of relying on a competitive tax environment for the foreseeable future, thus accelerating the current flight of companies and high-income tax filers to jurisdictions like Washington and Texas. Oregon’s preference for “targeted tinkering” while retaining the CAT fails to address the root cause of its non-competitive ranking.

An Effective Revival Strategy Requires Structural Surgery

To extricate Oregon from its economic doom loop, leadership must enact structural reforms that the Roadmap avoids. An effective economic revival strategy requires immediate, credible action in three areas:

- Immediate Repeal or Fundamental Restructuring of the Corporate Activity Tax: The CAT eliminated Oregon’s competitive edge in business taxation. An emergency legislative session in early 2026 should raise the CAT exemption substantially—for example, from $1 million to $5 million (as proposed in Senate Bill 1542 in 2024), which would eliminate the burden on approximately 70% of affected businesses.

- Confrontation of the PERS Liability: The $24–29 billion liability is an existential threat. Since Oregon’s constitution protects all earned pension benefits from reduction, an effective strategy must include campaigning for a constitutional amendment to enable prospective modifications to benefits for current employees, similar to reforms enacted in other states facing pension crises.

- Comprehensive Regulatory Streamlining with Quantitative Targets: The Roadmap’s direction to agencies to “identify opportunities to streamline” lacks credibility without measurable outcomes. Oregon ranks as the 7th most heavily regulated An effective strategy requires mandatory, quantitative targets, such as a 25% reduction in time-to-permit for major commercial and industrial projects within 24 months, coupled with the immediate elimination of redundant state-local permitting requirements.

Conclusion

Governor Kotek’s Oregon Prosperity Roadmap acknowledges the severity of the state’s economic decline. However, it prescribes administrative palliatives—Chief Prosperity Officers, Prosperity Councils, and deferred study—to solve structural, statutory, and fiscal problems.

The Roadmap’s resemblance to failed strategic plans dating back to Oregon Shines in 1989 reinforces the central economic verdict: the problem is a lack of political will to confront organized opposition and dismantle the high-cost, high-regulation structures that precipitated the decline.

The state’s competitive collapse—35th in tax competitiveness, 39th in business climate, 7th most regulated—is the predictable outcome of specific policy choices, notably the Corporate Activity Tax and the unchecked growth of the PERS liability.

The continuing cycle of strategic planning without structural reform ensures that Oregon will spend another decade managing economic decline rather than achieving competitive resurgence.