By Taxpayer Foundation of Oregon

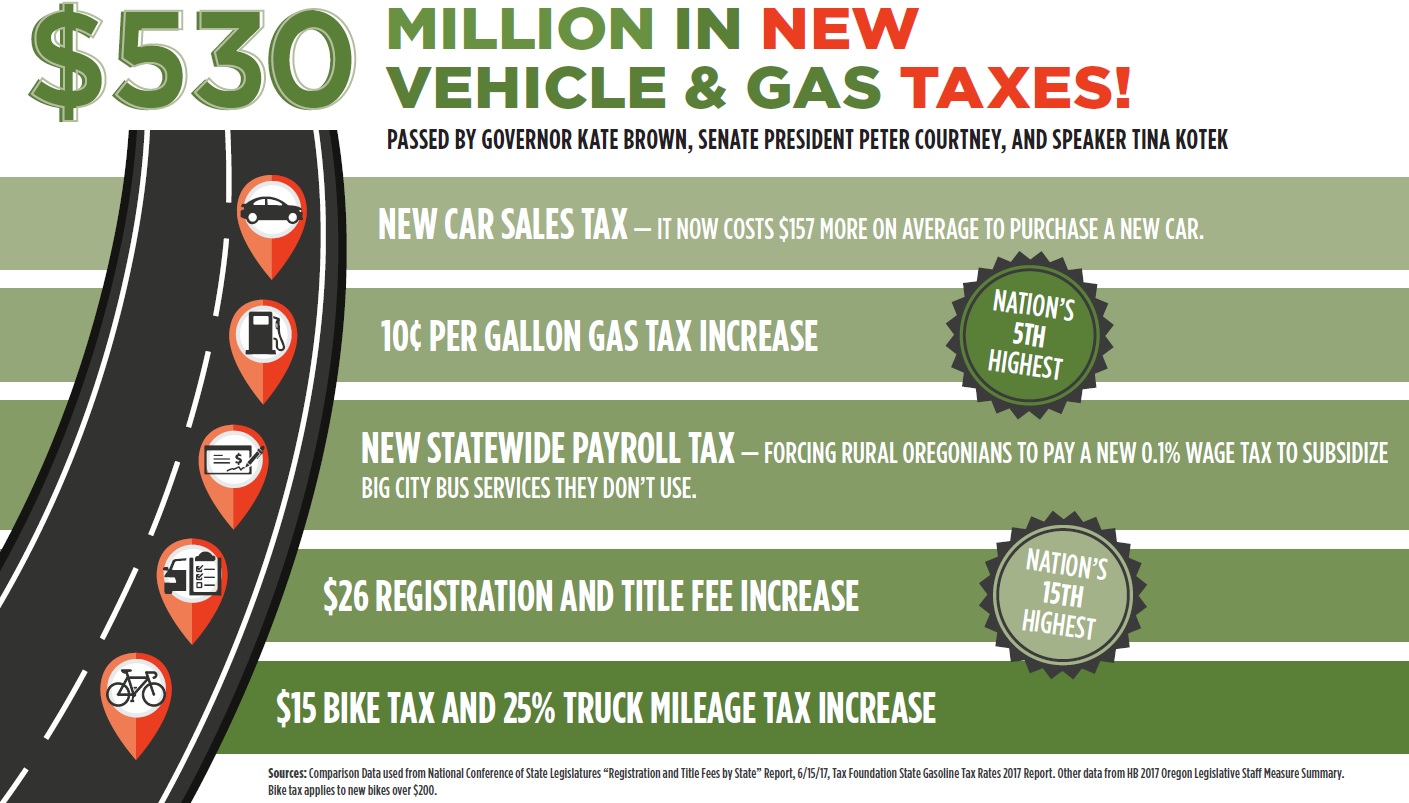

Oregon lawmakers just passed $530 million in new vehicle and gas taxes. Most Oregonians do not know the coming sticker shock and taxes that are heading their way.

Here is what the $530 million in new road taxes includes:

New car sales tax — it now costs $157 more on average to purchase a new car. This tax will be punishing to auto dealers along the Oregon border, like Ontario, that will have to compete with customers driving a few miles to save on the new tax.

10¢ per gallon gas tax increase. This new increase puts Oregon as the nation’s 5th highest gas tax.

New statewide payroll tax — forcing rural Oregonians to pay a new 0.1% wage tax to subsidize big city bus services they don’t use.

$26 registration and title combined fee increase. This fees combined make Oregon the nation’s 15th highest tax.

$15 bike tax — Oregon became the first state in the nation with its own bike tax.

25% truck mileage tax increase — Many of the media reporting on this tax failed to mention the huge 25% truck mileage tax increase which will hurt Oregon’s trucking industry.

This transportation tax package was passed by Governor Kate Brown, senate President Peter Courtney, and speaker Tina Kotek

Sources: Comparison Data used from National Conference of State Legislatures “Registration and Title Fees by State” Report, 6/15/17, Tax Foundation State Gasoline Tax Rates 2017 Report. Other data from House Bill 2017 Oregon Legislative Staff Measure Summary. Bike tax applies to new bikes over $200.