Williams is a life-long taxpayer advocate who has archived the state’s largest collection of government waste. Jason heads both the Taxpayer Association of Oregon Foundation and its sister organization, Taxpayer Association of Oregon.

By Taxpayer Association of Oregon Foundation, Fact: Virus cases could’ve been reduced by 95% if China had acted three weeks sooner according to Southhampton University. Timeline of China’s cover-up November 17, 2019. The first case of Coronavirus is discovered in China. A few weeks later (Dec. 6) the first case of human-to-human transmission…

READ MORE

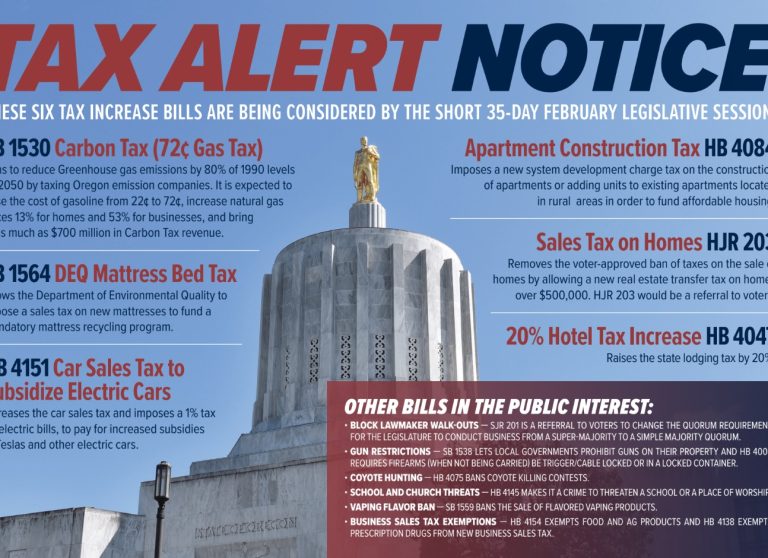

Tax Alert Notice: These six tax increase bills are being considered by the short 35-day February Legislative Session. Carbon Tax (72-cent gas tax): SB 1530 Aims to reduce Greenhouse gas emissions by 80% of 1990 levels by 2050 by taxing Oregon emission companies. It is expected to raise the cost of gasoline from 22 to…

READ MORE

By Taxpayer Foundation of Oregon, Like David and Goliath, residents of a tiny town on the Oregon Coast are battling Facebook, one of the world’s largest tech companies, over the social media company’s plans to build a landing spot for undersea cables. Residents in quiet Tierra Del Mar, about 65 miles southwest of Portland, worry…

READ MORE

Oregon taxpayers may see an even larger “kicker,” a credit on their 2019 personal state income tax returns, than previously anticipated. Previously, taxpayers were expected to receive an average $370 million refund in 2020 — now that kicker tax refund may grow much larger. The Oregon Department of Revenue noted that the kicker for 2018…

READ MORE

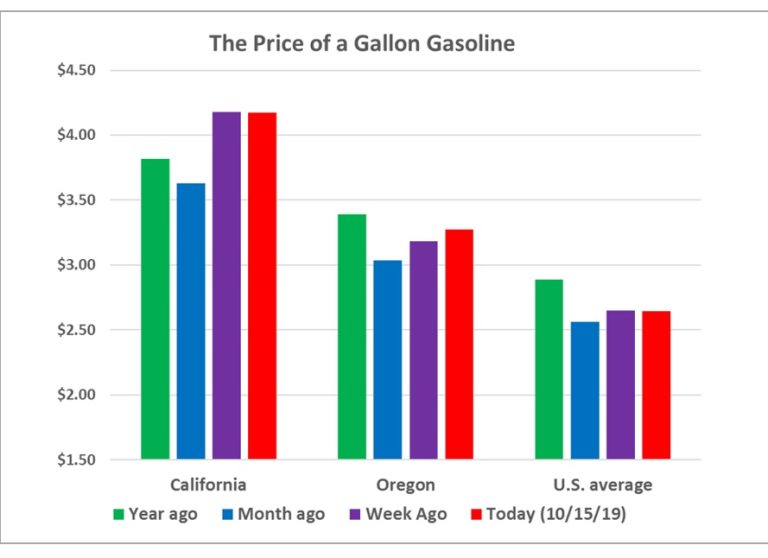

By Bob Clark, Taxpayer Association of Oregon Foundation Back in the year 2012, world oil prices are still at a peak and California is preparing to launch in 2013 its Cap and Trade Program to reduce CO2 emissions. Not to fall behind California, Oregon state politicians earlier this year (2019) attempt to enact approximately the…

READ MORE

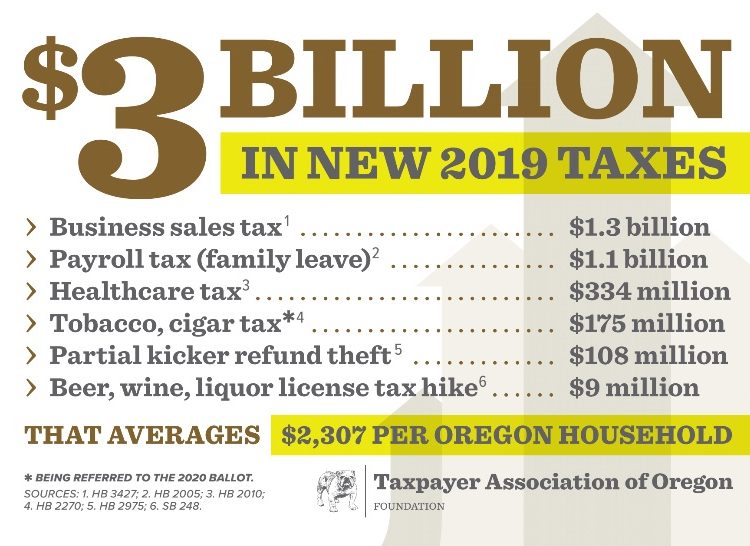

$1.3 billion Business Sales tax (HB3427) : House Bill 3427 (also called “Student Success Act”) imposes a 0.57% Commercial Activities (gross receipts) Tax on “business activity” (sales) exceeding $1 million per year, minus 35% of the “cost of inputs” (e.g. materials) or labor costs, plus a flat fee of $250. It taxes business sales revenue…

READ MORE

The majority of American workers travel to their workplaces, and they spend more time doing so, according to a traffic study that compared commuter times in 2008 with those of 2017. Commuters in Portland spend an average of 54 minutes going back and forth to work each day, and it’s grown longer in the…

READ MORE

By Taxpayer Association of Oregon Foundation Oregonians do live in tax hell. This tax season, Oregon taxpayers are sacrificing more of their tax money than most Americans. Oregon ranks as the nation’s fourth-biggest for state government spending, per capita, according to the latest data from the National Association of Budget Offices. That means 46 other…

READ MORE

Capitol Update Series: Developing high-speed internet connections in rural communities can expand business and economic opportunities, which is one reason Oregon Representative Lynn Findley authored House Bill 2455. The measure would define development and expansion of broadband Internet as economic development for purposes of the Eastern Oregon Border Economic Development Board. In 2017, the Legislature…

READ MORE

By Taxpayer Association of Oregon Foundation, Capitol Update series: State Representative Christine Drazan made it a priority this year to find solutions to protect seniors form Oregon’s increasing tax rate which is driving some Oregon senior citizens from their home. The state and local taxes Oregon residents pay on real and personal property, net worth,…

READ MORE